As students formally ask the University to divest from fossil fuels, Richard Assheton outlines the global movement.

What’s happening?

At 4pm today student and staff campaigners asked the University to commit to winding down their investments in the fossil fuel industry within five years. They handed a petition to new Vice-Chancellor Professor Hugh Brady.

They are not alone. All around the world people are campaigning for institutions to retract their investments from the fossil fuel industry — to ‘divest’.

The worldwide Fossil Free campaign aims to morally, more than financially, bankrupt fossil fuel companies. Campaigners hope stigmatising the use of fossil fuels will create reputational damage to those involved and slow the industry down.

The Rockefeller Brothers foundation has divested; the Church of England has divested in part; the cities of San Francisco, Oslo and Seattle have divested; eight UK universities, including the University of Glasgow and SOAS, in part or in full, have divested; Stanford University has divested from coal.

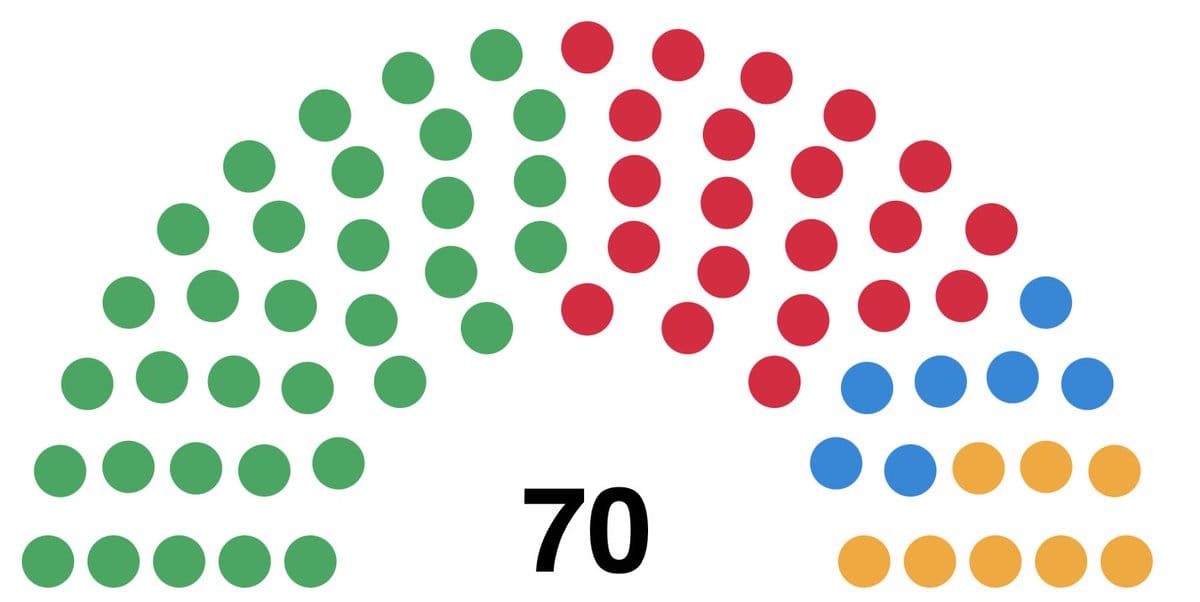

More than 220 institutions are committed to divesting in some form. Oxford University has called the campaign the fastest growing divestment campaign in history. The United Nations have backed it. All four Bristol West election candidates backed it.

#Divestment worked to free SA of #apartheid. Now it can help free us of #fossilfuels http://t.co/RWEszTzWvp @350 pic.twitter.com/0yWJOAn1y8

— UN Climate Action (@UNFCCC) February 11, 2015

Universities make investments to secure important income.

Through Sarasin and Partners, an investment manager, Bristol invests £56 million pounds in a wide range of sectors, including finance (e.g. Barclays), services (e.g. Amazon), pharmaceuticals (e.g. GlaxoSmithKline), media (e.g. Daily Mail), and technology (e.g. BT). It does not invest in the arms trade.

The University has committed to a net carbon neutral campus by 2030, and in the Cabot Institute Bristol has a world-leading climate change research centre, yet it also invests in fossil fuel companies, including Shell and BP.

The campaigners see a contradiction, and think Bristol’s position as European Green Capital 2015 gives the University ‘an excellent platform to show leadership to institutions around the world’.

They also say they have corresponded with Sarasin and Partners, who have told them a fossil free investment portfolio is perfectly possible.

At the time of writing, their petition, which also calls on the University to become a public advocate of divestment, has exactly 2,000 signatures.

Why?

The environmental argument is familiar: the world’s governments have agreed to stay under the ‘carbon budget’ — the quantity of carbon dioxide which will warm the Earth by no more than 2 degrees and may prevent global catastrophe.But the campaigners also cite a growing financial argument. Coal and oil prices have gone down. A Morgan Stanley Capital International report even said that in the last five years investment portfolios that did not include coal, oil and gas companies performed better than those that did.

On top of this, the Bank of England is now investigating the ‘carbon bubble’, a potentially devastating economic crash that might result from the overvaluation of fossil fuel resources.

Banks such as HSBC and groups such as the International Energy Agency have said that as much as two-thirds of the planet’s fossil fuel reserves will have to remain in the ground if we are to stay beneath the carbon budget — that means trillions of dollars worth of resources may be unusable.

HSBC has warned that 40-60% of the market value of oil and gas companies is at risk from the carbon bubble. They say that the top 200 fossil fuel companies have a value of $4tn, and that a quick downturn would be disastrous.Yet companies are still searching for resources, hoping that they will continue to profit. Shell refute the concept of a carbon bubble, and predict that fossil fuels will still provide 40-50% of our energy supply long after 2050. There are plenty of arguments in favour of fossil fuels – or at least against the Fossil Free campaign – and plenty have refused to divest.

Whilst supporters of the campaign have made it clear that they want to morally, not financially, take the legs from beneath fossil fuel companies, some have called this gesture politics, saying that other companies will simply pick up divested shares. Others have citied our modern lives’ reliance on fossil fuels. A video made for Big Green Radicals, which condemns large green charities like Greenpeace, imagines an empty world without the energy coming from traditional sources. Some have used moral grounds to condemn the campaign, saying that developing economies rely on fossil fuels and that divestment from fossil fuels is prioritising the possibility of harm to our great-great-grandchildren over definite harm to the poor today. And universities? The University of Edinburgh will not divest, and is one of a number of institutions who believe engagement with these companies is better than disengagement. The president of Harvard University has called its endowment ‘an economic resource, not an instrument to impel social or political change’. You can watch the Guardian's Keep it in the Ground video here: Featured image: University of Bristol Have you signed the petition? Would you support Bristol's divestment? Are we wrong to divest from fossil fuels? Let us know in the comments below or tweet us @EpigramFeatures.Who disagrees?

Latest