By Hope Riley, Living Editor

As someone who's idea of 'budgeting' is getting in an Uber Pool, Monzo, the self-proclaimed 'bank of the future,' has helped me to successfully monitor my spending at uni.

Monzo was founded in 2015 by a team of four ex-employees of Starling Bank. The start-up business began with the launch of their fluorescent coral top-up card – these prepaid Mastercards could be topped up in-app by bank transfer or via existing debit cards. Later, in April 2017, Starling’s young entrepeneurs were granted licence to set up a Current Account for all users, which replaced the previous top-up system.

The mobile-only Current Account functions much in the same way as the old top-up cards, with everything controlled via the app, but with the added option to make bank transfers (both U.K. and international), and to set up direct debits and standing orders. With the introduction of the Current Account, the card can also be added to your virtual Apple 'Wallet' for mobile use.

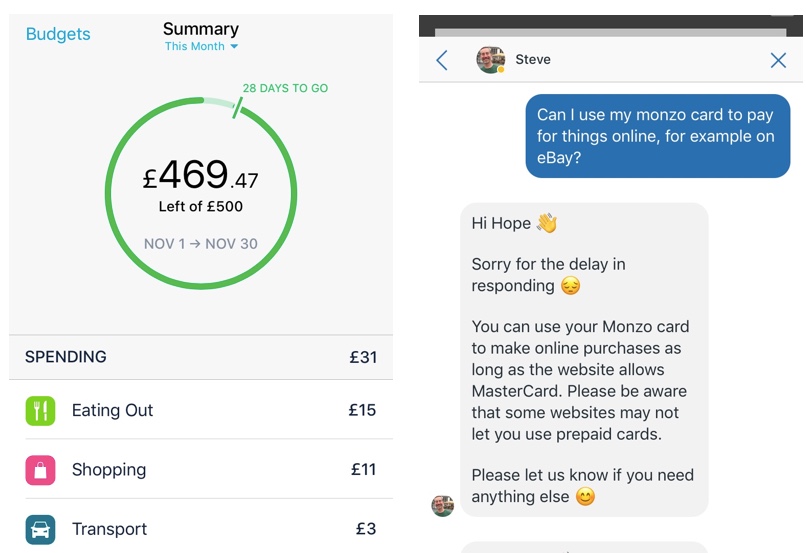

When you start using your Monzo card, push notifications are sent to your phone in real-time that log your spending. This data is then collated to generate a review of your spending across the day, and another more detailed review across the whole month. The review breaks down your spending across a variety of categories: shopping, transport, groceries and so on.

In my opinion, the best feature of the service is that contactless payments are deducted immediately from your balance – you do not have to wait 2+ days for your balance to be updated, a.k.a. no nasty surprises when you belatedly realise that you generously footed the bill for a round of drinks in Mbargos on Thursday night.

Another useful element is the ‘alerts’ that pop up on your phone to remind you to stick to your budget. Once you get over the somewhat invasive (and at times judgemental) tone of these alerts (e.g: ‘Hope, you’ve already gone £13.78 over your weekly budget'), you begin to recognise the benefits of such intervention.

It is also worth mentioning that there are no fees or extra charges for spending abroad with your Monzo card, which makes it ideal for bringing along on your holidays or travels.

So what’s the catch?

The most obvious downside I can pinpoint to Monzo is the fact that there are no physical bank branches, with almost all correspondence with the bank taking place via the ‘Live Chat’ function on the app. While this can make you feel slightly as though you are in an episode of Black Mirror, I’ve found it is actually quite handy to have all your Customer Service needs met in one place. The founders of Monzo have also chosen to disregard using chequebooks, deeming them ‘obsolete.’ Fair enough.

Epigram / Hope Riley

Another drawback is that there is an upper limit to cash withdrawals – you can take out up to £200 per 30 day period, but there is a 3% charge for withdrawals after that.

The only other issue I’ve encountered with Monzo is with ring-fencing, which I’ve experienced on a couple of occasions. Ring-fencing is essentially an instance where the merchant tells you that your payment has been declined, but the money still leaves your account and is subtracted temporarily from your balance. The balance usually re-equilibrates itself and the money is refunded automatically, but if this doesn’t happen within a week then you just have to take a photo of the ‘declined’ receipt and send it to a team member on the Live Chat, who will sort it out for you.

While I am by no means a financial advisor, I can honestly vouch that transferring my Current Account to Monzo has made managing my money at uni so much easier. Sign up for your Monzo card at the link here: https://monzo.com/

Featured image: Unsplash / Oliur

How do you manage your finances at uni? Epigram wants to know - get in touch!